The crypto economy has managed to remain above the $2 trillion mark during the last five days since March 22. Currently, the global cryptocurrency market capitalization is 1.3% higher during the last 24 hours, as the valuation stands at $2.1 trillion today. Furthermore, the price of bitcoin jumped over the $46K zone on Sunday as well capturing an $870 billion market cap.

Digital Assets Gain This Week, Bitcoin Cracks $46K, TVL in Defi Holds Above $200 Billion

Digital currencies have gained in value during the last seven days and for five consecutive days, the crypto economy’s total value has held above $2 trillion. The last time the crypto economy was above the $2 trillion zone was during the first week of March.

At 4:45 p.m. (ET) on Sunday, March 27, 2022, the price of bitcoin (BTC) tapped a high of $46,615 per unit.

At 4:45 p.m. (ET) on Sunday, March 27, 2022, the price of bitcoin (BTC) tapped a high of $46,615 per unit.

During the last seven days, bitcoin (BTC) increased by 8.9% and ethereum (ETH) gained 8.5% against the U.S. dollar. Out of the top ten largest crypto market caps, cardano (ADA) saw the biggest seven-day gain with 26.5% this week.

The crypto economy has managed to stay above the $2 trillion mark for five consecutive days. Data from coingecko.com from March 19 to March 26, 2022. Bitcoin rose above the $46K mark at 4:45 p.m. (ET) and at the same time ethereum jumped above the $3,220 region on Sunday.

The crypto economy has managed to stay above the $2 trillion mark for five consecutive days. Data from coingecko.com from March 19 to March 26, 2022. Bitcoin rose above the $46K mark at 4:45 p.m. (ET) and at the same time ethereum jumped above the $3,220 region on Sunday.

The 13,421 crypto assets traded on 587 exchanges currently has a market valuation of $2.1 trillion and its risen 1.3% during the last day.

The biggest gainer during the last week was zilliqa (ZIL) jumped 148% this week, convex finance (CVX) spiked 53.2% higher, and vechain (VET) increased by 44.9% over the last seven days.

The top privacy coins by market valuation increased by 3.4% in 24 hours, and the top smart contract platform coins by market capitalization rose in value by 1.7% on Sunday. Furthermore, the top rebase tokens by market capitalization increased by 9% during the last 24 hours against the U.S. dollar.

While the value of the crypto economy is $2.1 trillion on Sunday, over the last day there’s been $78.5 billion in global trade volume on exchanges.

At the time of writing, bitcoin (BTC) has a market dominance of around 40.3% of the crypto economy’s value and ethereum (ETH) represents 18% of the $2.1 trillion. The stablecoin tether (USDT), which is the third-largest crypto market valuation, has a market dominance today of around 3.84%.

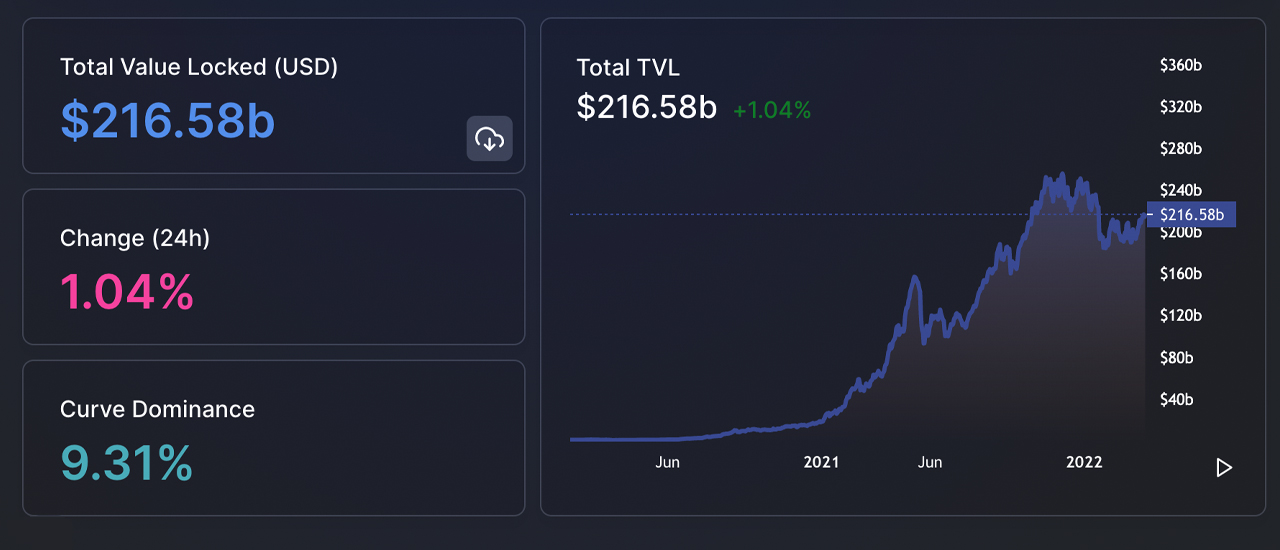

The total value locked (TVL) in decentralized finance (defi) on Sunday is $216 billion as it’s increased by 1.04% during the last 24 hours.

The total value locked (TVL) in decentralized finance (defi) on Sunday is $216 billion as it’s increased by 1.04% during the last 24 hours.

Out of the $78.5 billion in global trade volume on exchanges, $42.7 billion of those trades are swapped with stablecoins. The overall value of the stablecoin economy on Sunday is $188.9 billion.

In addition to the $2.1 trillion crypto economy, $216.58 billion is locked in decentralized finance (defi) protocols. The total value locked (TVL) in defi today has increased 1.04% in value during the last 24 hours. The largest defi protocols in terms of TVL include Curve Finance, Makerdao, Lido, Anchor, and Aave.

Tags in this story

$2 Trillion, $2 trillion mark, $2 trillion zone, Bitcoin, Bitcoin (BTC), bitcoin dominance, BTC, crypto economy, Crypto Economy Valuation, DeFi, Dominance, ETH, Ethereum (ETH), Fiat, Increases, Markets, markets and prices, privacy coins, rebase tokens, smart contract coins, Stablecoins, TVL in defi, USD, vechain (VET), zilliqa (ZIL)

What do you think about the crypto economy managing to hold above the $2 trillion zone for five consecutive days? Do you expect digital assets to increase in value next week or slide? Let us know what you think about this subject in the comments section below.

![]()

Jamie Redman

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.