Since around 2017, economically, few nations had started facing some form of hurdle/s which assisted in turning almost every nation’s GDP (Gross Domestic Product) somewhat fatalistic in 2020. The desire of turning a centralized way of governance into a decentralized one started in 2008-09 after the “Financial Crisis/The Great Recession”. A lot of prototypes came into existence which helped various sectors. The COVID-19 (Corona Virus) pandemic in a way assisted in showcasing that decentralized, transparent, and a system where one is accountable is the need of the hour. If you’re among those who rely highly on traditional economics (micro and macro), or if you aren’t familiar with backend functioning of codes/algorithms, then you might not understand the reason/s decentralized finance is growing rapidly while the economy is moving towards depression. This piece dwells into why/how decentralized finance (DeFi) is increasing when the general economy is moving towards depression.

One way of seeing the current scenario is that because a majority of financial institutions across the world has been functioning in a centralized fashion, the economy is moving towards depression. One observation that a couple of economic as well as technological experts have stated that the current economic situation has happened due to improper handling inflation targets (undershooting), and muting inflation expectations as well here. Besides the above-mentioned factor, ongoing debt cycle since 2008-09 initially in the United States of America and major European nations which then spread to other Asian countries as well is another factor that is perceived to lead to the current scenario. Another way of looking at the economic situation is negligence towards small-and-medium-sized businesses to gain access to credit markets. These were few factors which were seen common among various experts in micro-level as well as macro-level functioning in a couple of nations. One solution to resolving the issue is via the acquisition of private-sector stocks and bonds (also referred to as fiscal quantitative easing). Another way resolving/trying to resolve the issue is through setting up a dual currency system, where the government would declare the real currency is electronic bank reserves. It should be kept in mind that each nation functions in a unique manner, hence whether such solutions could be possible on the ground or not, if yes then how they can be implemented varies. The following piece of research suggests distinct fresh infrastructure systems that can assist in avoiding such an economic situation to occur again in future.

Here, table 3 differentiates unique forms of money that have been utilized to date. Ranging from

- Private physical substitutes,

- Physical fiat,

- Electronic fiat,

- Electronic eMoney,

- Non-DLT electronic substitutes, to

- DLT Electronic substitutes

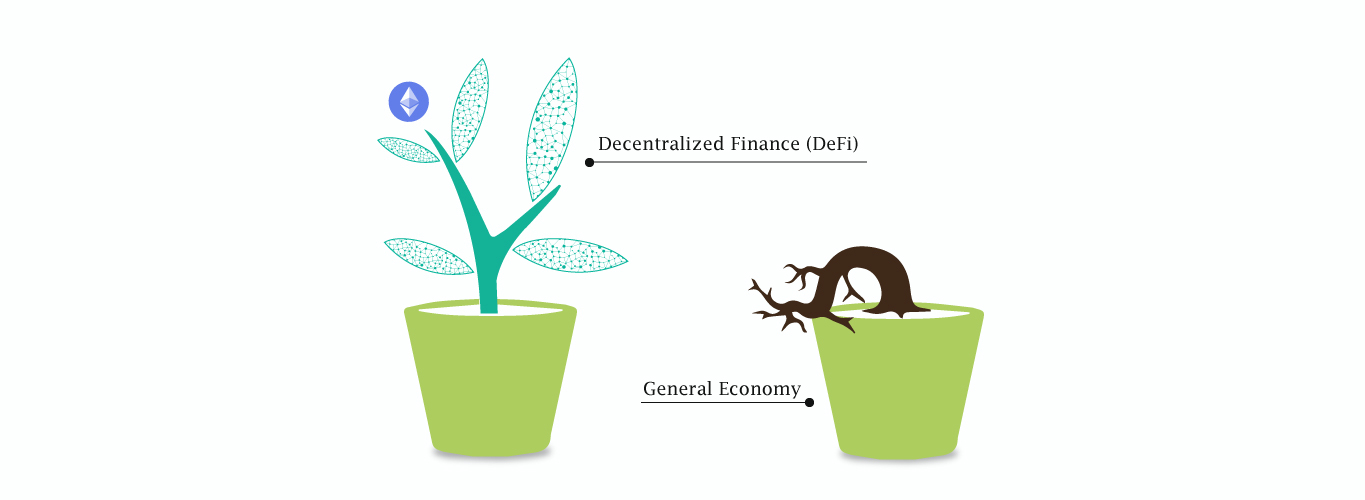

In each type, what kind of mode was utilized, who was at the receiving side as well as the sending side, and lastly their characteristics are mentioned. A broader perspective of functioning in the inter-financial area is showcased in figure 1. In figure 1, the overall transformation in banking services along with fresh technologies is shown. So far the emphasis has been on the theoretical side of centralized finance and the urgent need of decentralized finance platforms and applications which could become as simple-and-straightforward as using Facebook. The image below is an illustration which could make a relevant potential case for reference.

As one may infer from the infographic, the potential illustration is trying to distinguish between Facebook’s Libra and China’s DCEP and pinpointing the similarities between both simultaneously. All digital tokens mentioned under the corporate (blue circle), could be considered as those which will be economically and sustainably viable for corporate(s). While Libra 1 will encompass multiple fiats, Libra 2 consisting single fiat, while Libra 3 not being compatible with ant fiat. The piece of research at the end concludes that decentralized finance will become the norm in the coming days. Just like usage of gold shifted to notes/coins as currency, similarly the shift will happen to decentralized currency very soon. The next piece of research dwells into the Stochastic Model of Stablecoins.

The model mentioned here was developed to overcome a scenario which recently happened, where around 50% of cryptocurrencies prices dropped in a single day. The proposed model’s name is “Stochastic Model of Stablecoin(s)”. The model consisting of over-collateralized stable assets, non-custodial stablecoins having an endogenous rate. The prototype’s system functions around a speculator’s ability to resolve an issue which in return receives leverage as potential liquidation costs. This paper proves that stablecoin acts stably by bounding the probabilities of large variations restricted to a particular region. It’s also showcased that price variance is higher in a specific region, which can be triggered via big variations, minimal expectations, and liquidity issues from deleveraging.

From the few prototypes mentioned above, it could be pointed out that because of the numerous open-sourced algorithms running at the backend of these proposed models, decentralized finance didn’t get much affected as compared to the general economy. From scrutinizing and observing the positive outcomes and reaching closer to turning it mass-economical, you could expect to see a lot of reforms in the financial sector across nations. To know about the latest updates in the blockchain ecosystem, visit Primafelicitas.