Days after the London Hardfork went live, Ethereum (ETH) has been experiencing an uptick in prices as the second-largest cryptocurrency is set to become deflationary based on this upgrade.

ETH was up by 16.52% in the last seven days to hit $3,228 during intraday trading, according to CoinMarketCap.

Ethereum whales are not relenting in their accumulation quest because addresses with more than 100k coins now hold 43.7% of ETH supply, as acknowledged by Santiment. The on-chain metrics provider explained:

“Ethereum whale addresses aren’t stopping their accumulation as prices hover above $3,100. Three years ago to the day, addresses with 100k+ ETH owned 35.8%. Today, they own 7.9% more of the second market cap asset’s total supply. There are 1,338 of such addresses.”

These statistics show that Ethereum whales’ accumulation has been on an upward trajectory because they owned 35.8% of ETH supply three years ago compared to the current 43.7%.

Is Ethereum eyeing the $4,000 level?

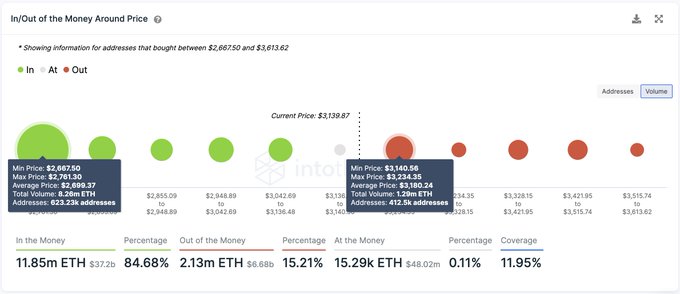

According to market analyst Ali Martinez:

“The IOMAP shows that Ethereum could run to $4,000 if ETH manages to close above $3,235. A rejection from this supply barrier could lead to a spike in selling pressure that pushes ETH to $2,700.”

Martinez believes that a run to the $4,000 level is relatively open because Ethereum currently stands at the zone, which it has to break for more upward momentum to be attained.

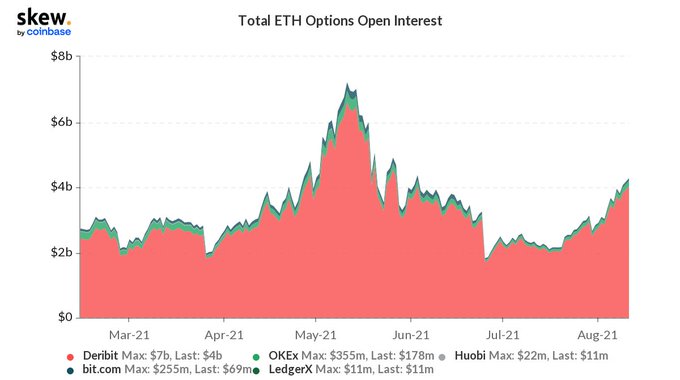

On the other hand, Ethereum options open interest recently surged to a two-month high.

ETH was recently boosted after the London Hardfork or EIP 1559 was implemented because a base fee for every transaction carried out will be set. As a result, giving all a fair opportunity.

Furthermore, users who may wish to conduct their transactions faster than the standard provisions of the network can add a tip to validators to fast-track their transactions. Part of this tip is burnt, helping to improve the monetary policy of the Ethereum network as a whole and making it deflationary.

With ETH options open interest topping $4 billion, whether this will boost Ethereum’s journey to the $4,000 level remains evident.

Image source: Shutterstock