The resignation of Meteora’s co-founder Ben Chow adds another twist to the LIBRA memecoin saga.

Argentinan president Javier Milei thought he was Argentina’s Trump and could scam his fans, but the pyramid turned out to be much smaller than anticipated. Now people will see jail time. Et tu Solana?

Ain’t no way these people aren’t going to prison:

– Running 9 figure scams using heads of states as bait

– Doxxed & living is LA

– Admitting to inside corruption/collusion

– Exchanges involved – Meteora, Jupiter

– LA based streamers & KOLs involved

pic.twitter.com/T0V5UEsZOr pic.twitter.com/NWVS8qdSMG

— $trong (@StrongHedge) February 17, 2025

We’re dealing with unique problems this cycle that didn’t apply in previous cycles:

- HORRIBLE global economic macros

- Additional tariffs (some justified and others not) scarring the market

- Solana threw a wrench into alts/shitcoins this cycle

- Normies are further demoralized by getting rekt from Trump, Melania, Libra, Hawk Tuah, amongst other celeb pnd’s (this ties into the SOL issue)

Here’s a closer look at the scandal, LIBRA’s dramatic rise and fall, and the political tensions it has sparked, not just for the token but also for figures like Argentine President Javier Milei.

Meteora Co-Founder Resigns After Libra Memecoin Failure

Ben Chow’s resignation was announced on X by “Meow,” the pseudonymous co-founder of Meteora and Jupiter, another Solana-based platform. Meow emphasized the company’s commitment to transparency and reassured the community of its intent to address the allegations effectively.

“We take allegations of insider trading EXTREMELY seriously,” Meow wrote on X. “Neither Meteora nor Jupiter is guilty of financial misconduct.”

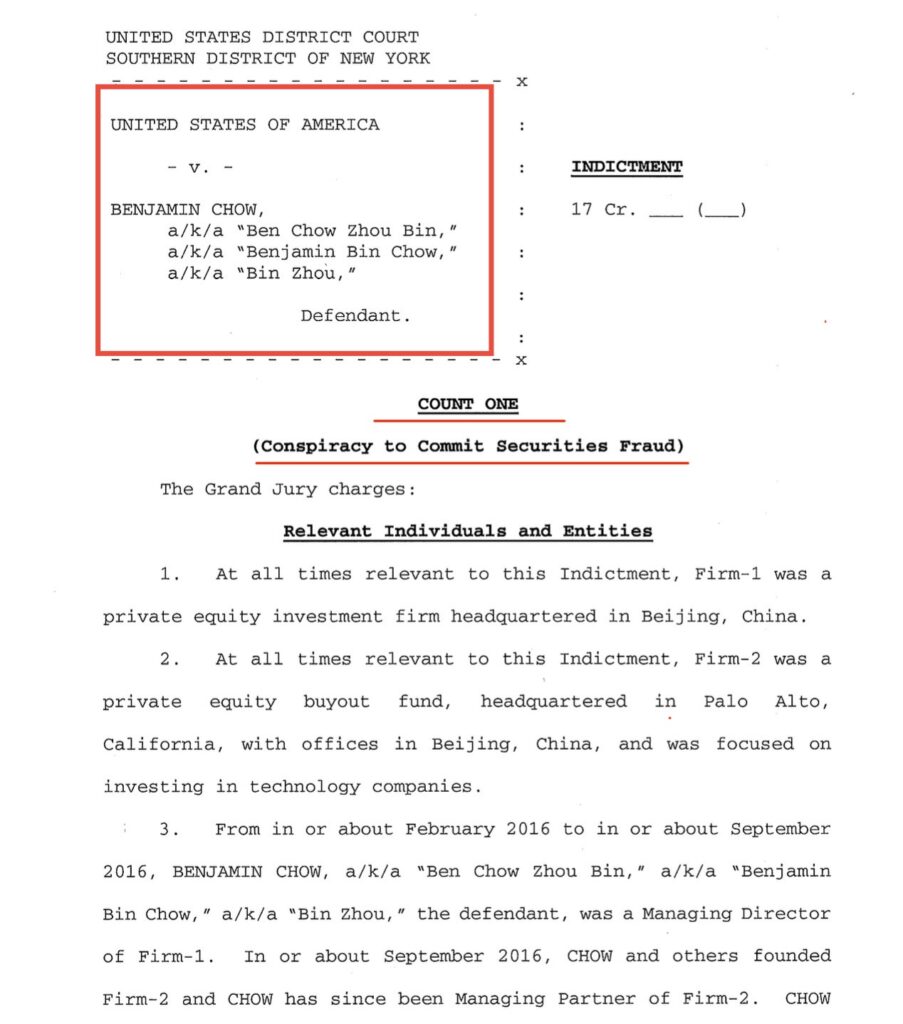

(Ben Chow charged for 34 cases of Fraud in 2016 | SEC)

To reinforce this commitment, the companies have hired Fenwick & West, a respected legal firm, to conduct an independent investigation. Meow promised that the review results would be made public to ensure accountability.

Despite expressing confidence in Chow’s character, Meow cited a lack of judgment in Meteora’s operations as a contributing factor to the resignation.

The LIBRA Memecoin and Allegations Engulf Argentina President Milei

The scandal revolves around LIBRA, a meme coin that soared to mainstream attention after being endorsed by Argentine President Javier Milei.

What began as a rising star in the crypto world soon crashed spectacularly, with LIBRA’s value plummeting from $4 to less than $0.50 in mere hours.

The dramatic collapse has been linked to market manipulation, with reports alleging that insiders cashed out over $100 million in liquidity, leaving investors to absorb enormous losses. Chow, according to accusations, privately received or managed LIBRA tokens—a claim that has fueled outrage and distrust.

It’s all unravelling so quickly. In the past hour we found out that Jupiter owner Meow is the real owner of Meteora. Ben lied about having no involvement with Libra and other Kelsier launches and was fired from Meteora. Gotta imagine Solana and its execs knew this the whole time. pic.twitter.com/n5F8IC5H3W

— Beanie (@beaniemaxi) February 18, 2025

President Milei’s involvement with LIBRA has sparked significant political turbulence in Argentina. Milei, who publicly promoted the token, is now under investigation by the nation’s Anti-Corruption Office.

Federal Judge María Servini also oversees a legal probe into potential fraud and market manipulation related to the meme coin’s controversial launch.

Sociopathic scammers from the Solana culture have now dominated the crypto market. These are people whose perspective is that crypto is literally just a place where you can scam people for easy money. The LIBRA trainwreck gives us a glimpse into the massive rabbit hole.

They have zero inkling that crypto, blockchain, DLT, whatever, has any benefit other than being an arena for scamming. Sad!

Lessons for the Crypto Industry: Stop Bidding Solana Celebrity Meme Coins

tldr; Argentina’s president Javier Milei launched a meme coin called $LIBRA, claiming it would boost the country’s economy. However, within five hours, $4.4 billion vanished as insiders dumped their holdings.

After the LIBRA crash, Binance co-founder Changpeng Zhao donated 150 Binance Coin (BNB) to help fix the damage. But no amount of goodwill can fix the larger problem plaguing crypto—an unregulated space that leaves small investors drowning in losses.

The fallout has drawn interest from the blockchain community and political circles, raising bigger questions about responsibility and the glaring gaps in crypto oversight.

Solana has become a community increasingly tantamount to a drunken Reno casino, brimming with sharks and scammers. You might want to cash out while you still can.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Sociopathic scammers from the Solana culture have now dominated the crypto market.

- The LIBRA meme coin controversy serves as yet another reminder of the risks associated with hypervolatile assets like meme coins.

- For the crypto ecosystem, instances like these cast a long shadow, raising concerns about transparency, accountability, and the industry’s long-term reputation.

The post JUPGATE Rips Libra Memecoin: Jupiter Just Lifted The Lid on Solana Meme Coin Cabals appeared first on 99Bitcoins.